- The Money Edition

- Posts

- 📊 Mutual Funds vs Stocks vs ETFs: What Should You Invest In?

📊 Mutual Funds vs Stocks vs ETFs: What Should You Invest In?

A deep dive into how each one works — and which suits your goals best.

👋 Hey there!

If you're looking to grow your money but aren't sure where to start, you're not alone. With so many options — stocks, mutual funds, ETFs — it’s easy to feel overwhelmed.

But here’s the good news: you don’t need to know everything to begin, but just the right basics.

In this edition, we’ll break down all three investment options, compare them side by side, and help you figure out which one matches your comfort, goals, and risk appetite.

Let’s simplify your investment journey 👇

🧠 What’s the difference anyway?

When it comes to investing, the three most common choices are:

Stocks — buying shares of individual companies

Mutual Funds — pooled investments managed by professionals

ETFs (Exchange Traded Funds) — a mix of stocks/bonds traded like shares

But which one fits you best? Let’s break it down.

🧩 1. Stocks: Direct Ownership

What are they?

Stocks (also called shares or equities) represent ownership in a company. When you buy a stock, you become a part-owner of that business, with a claim on its profits and assets.

How do you earn?

Capital Gains: You earn when the stock price increases and you sell it.

Dividends: Some companies share profits with investors periodically.

Pros: | Cons: |

Who it’s for?

Confident investors who want control and are comfortable with volatility

Those who can dedicate time to research and track markets

Risk-takers with long-term goals who seek potentially high returns

🧩 2. Mutual Funds: Professionally Managed Basket

What are they?

A mutual fund is a pool of money collected from multiple investors and managed by a professional fund manager. The fund manager invests this money in a diversified mix of assets like stocks, bonds, or gold. You, as an investor, buy units of the fund based on its NAV (Net Asset Value — the per-unit market value of the fund’s holdings).

How do you earn?

Capital Appreciation: When the value of the underlying investments rises.

Dividends/Interest Income: Some funds pass on returns from dividends or interest.

NAV Growth: As the fund’s value grows, so does your share in it.

Pros: | Cons: |

Who it’s for?

Beginners looking for professional management

Anyone seeking diversification with lower effort and without monitoring

Long-term planners aiming for retirement, education, or large life goals

🧩 3. ETFs: The Best of Both Worlds?

What are they?

ETFs are funds that trade like stocks but behave like mutual funds. Most ETFs passively track a benchmark index (like Nifty 50). You can buy and sell them during trading hours on stock exchanges.

How do you earn?

Market Price Growth: As the tracked index or basket of assets grows, so does the ETF’s price.

Dividends: If the underlying securities pay dividends, ETFs may distribute them too.

Pros: | Cons: |

Who it’s for?

Investors who want diversification and liquidity

Passive investors looking for low-cost, long-term strategies

Anyone who wants the simplicity of mutual funds with the flexibility of stock trading

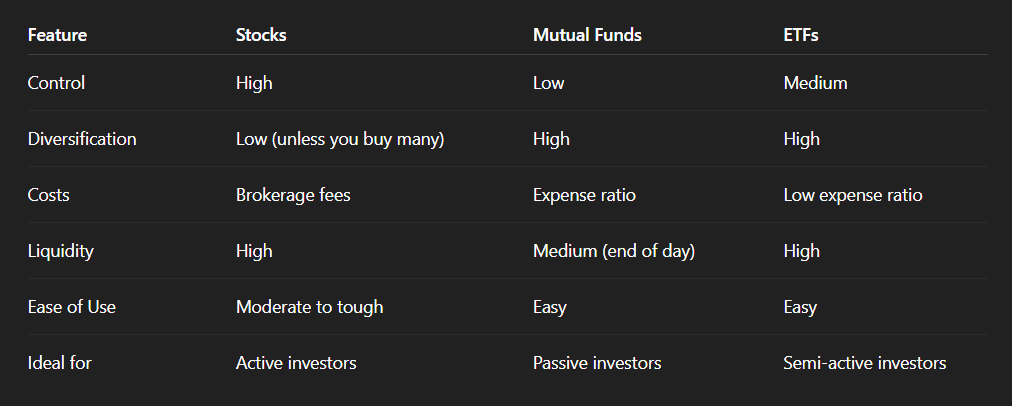

📊 Quick Comparison Table

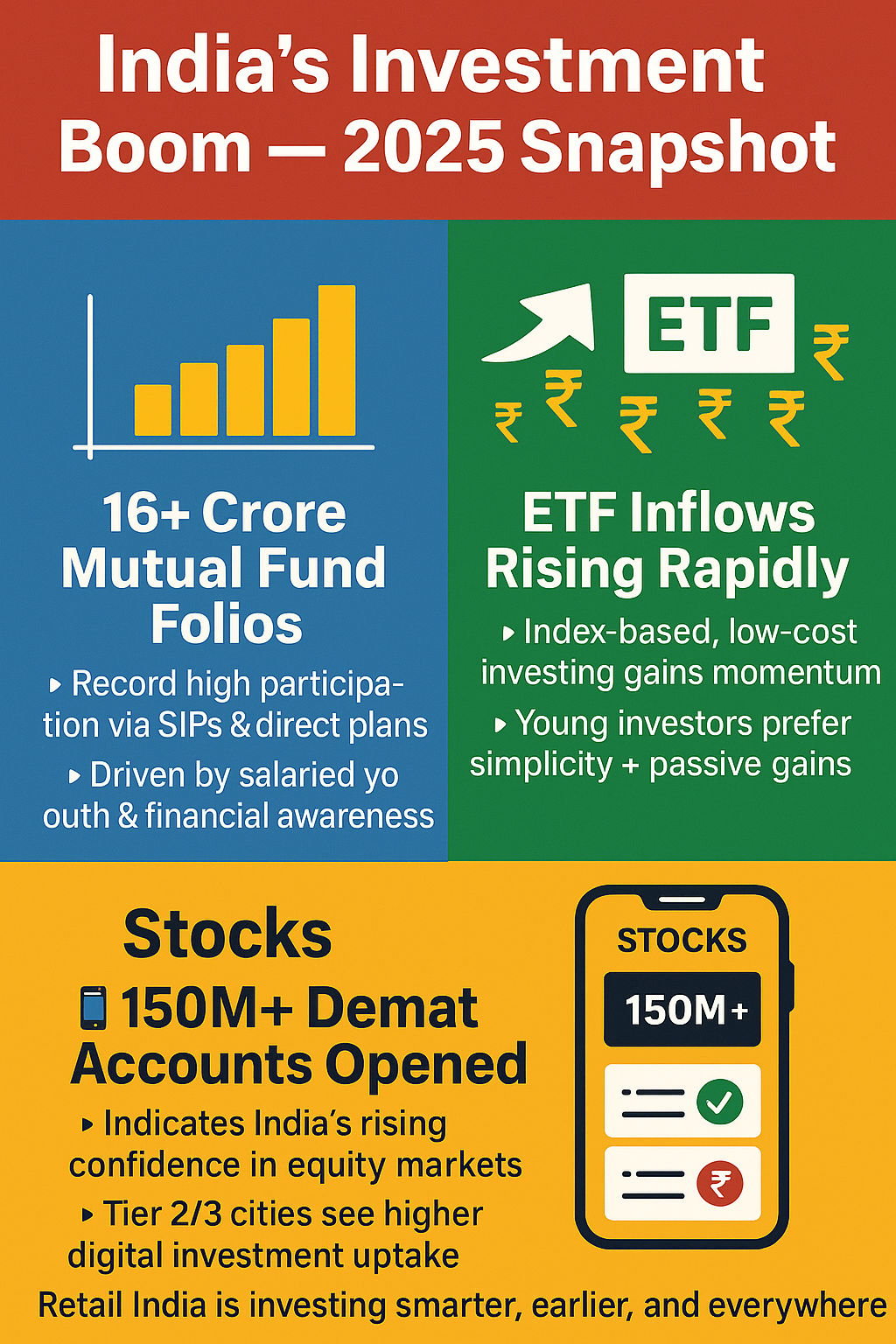

📰 Current Affair

| 📈 According to AMFI data (2025), retail participation in mutual funds has touched record highs — with over 16 crore folios. Meanwhile, ETF inflows are rising, with young investors flocking to index-based options due to lower costs and simplicity. Simultaneously, demat account openings have surged to 150 million+, showing India’s rising love for direct stock investing. |

🧠 Expert View

“If you're just starting out, ETFs can offer a balanced entry point — lower cost, passive returns, and instant diversification,”

says Radhika Gupta, CEO of Edelweiss AMC.

"But if you’re serious about wealth creation, learn how stocks work. Long-term conviction beats short-term convenience."

💡 Quick Tip

If you're confused, start with an ETF linked to Nifty or Sensex, like Nifty 50 ETF.

It’s simple, low-cost, and gives exposure to India’s top companies — a safe first step.

🧾 Final Thought

There’s no one-size-fits-all investment — only what fits you.

Whether you pick the sharp focus of stocks, the balanced comfort of mutual funds, or the flexibility of ETFs, the key is to start and stay consistent.

Until next time,

The Money Edition

Bringing you clarity on choices that shape your future 💡