- The Money Edition

- Posts

- 🚀 VC Funding: How Startups Get Their First Crore

🚀 VC Funding: How Startups Get Their First Crore

Understanding Venture Capital & Early-Stage Funding in India

👋 Hey there!

Ever wondered how startups like Zomato, Zepto, or Razorpay raised crores before making a single rupee in profit? The answer lies in venture capital — a powerful engine that is driving India’s startup boom.

In this edition, we’ll break down what VC funding really is, how it works, who gives the money, and how founders land their first crore (or more). Whether you’re an aspiring entrepreneur or just VC-curious — we’ve got you covered. 👇

💰 What is VC Funding, Really?

Venture Capital (VC) is funding given to early-stage or growing startups with high potential — but also high risk. It’s not a loan. You don’t repay it with interest. Instead, you give up equity (shares) in exchange for capital.

✅ What you get: Money to scale, access to networks, mentorship

❌ What you give: A percentage of ownership and decision-making power

Startups use VC funding to build products, hire teams, and gain traction fast. The Reason? VCs expect massive returns within a few years.

🧠 How Do VCs Work?

Understanding their role, purpose, and how they make money

Venture Capitalists (VCs) aren’t just generous individuals handing out cash — they’re professional investors managing money from limited partners (LPs), such as:

Pension funds

Insurance companies

HNIs (High Net Worth Individuals)

University endowments

They pool this money into a VC fund, which they manage over a 7–10 year period (i.e. the VC fund will invest and manage startups withing these 7-10 years cycle before they exit).

💡Their Role:

Discover high-potential startups

Invest in early stages (seed, Series A, etc.)

Support founders with mentorship, network, hiring, strategy

Exit profitably when the startup is acquired or IPOs

💸 How Do They Make Money?

VCs earn in two ways:

Management Fee (2%) – Annual fee for managing the fund

Carried Interest (20%) – Share of profits when investments succeed

For example, if a VC fund invests ₹5 Cr in a startup at an early stage and the company grows and is acquired for ₹100 Cr, the fund gets a massive return — often 10–50x on that investment.

But here’s the catch: not all startups succeed. Hence, it’s a risky game.

🧠 Why this matters for founders

VCs are return-driven, so they’ll push for scale, market dominance, and fast growth. That’s why alignment on vision and expectations is critical before taking VC money.

🏁 How Startups Get Their First Crore

VC funding isn’t instant — it happens in rounds, starting from small checks to multi-crore investments.

Here’s the typical path:

👥 Angel Round / Friends & Family

₹5–50 lakhs from known contacts or angel investors

Idea stage; focus is on vision and founder credibility

🌱 Seed Round

₹50L – ₹3Cr from early-stage VCs or accelerators

Startups may have a basic product and early users

🌀 Pre-Series A / Series A

₹5Cr+ from institutional VC funds

Now it’s about scaling with data, team, and product-market fit

✅ To raise your first crore, you need:

A clear, scalable business idea

Proof of traction (users, revenue, or engagement)

A solid pitch deck and financial plan

Strong storytelling and networking skills

🎯 What VCs Look for Before Investing

It’s not just about ideas — VCs invest in execution. Here’s what they want to see:

1. 💼 A Strong Founding Team

Complementary skill sets (tech + ops + business)

Track record of building or working in startups

Ability to hustle, learn, and adapt

2. 🌍 A Large Addressable Market

Solving a problem that impacts millions, not hundreds

Bigger market = bigger potential upside

3. 💡 Real Problem + Scalable Solution

Clear pain point

Solution that can scale without exploding costs

4. 📈 Early Traction

Even small indicators — signups, waitlists, early revenue — prove market demand

5. 🛡️ Some Defensibility

Tech edge, distribution moat, unique user insights, or IP

💬 “Investors bet on jockeys (founders), not just horses (ideas).”

🤔 Can Anyone Become a VC?

Technically, yes — but it’s not a straight path.

Venture capital isn't a profession with a single clear entry route like law or medicine. Instead, it rewards:

Curiosity about startups

Strong networking

Financial acumen

Hands-on experience

It’s not just for billionaires in suits. Today, there are more alternative ways to enter VC than ever before. Here are different ways in which people break into VC:

Startup Founders who exit their company with capital

Finance professionals (IB, consulting, CA, MBA grads)

Angel Investors who build deal flow and reputation

Operators who’ve worked in fast-growing startups

VC Analysts and Associates who rise through firms

You don’t need to be rich to get started — but you do need to offer value, whether through insight, deal flow, or operational experience.

💡 In short: Anyone can become a VC. Not overnight — but with effort and exposure.

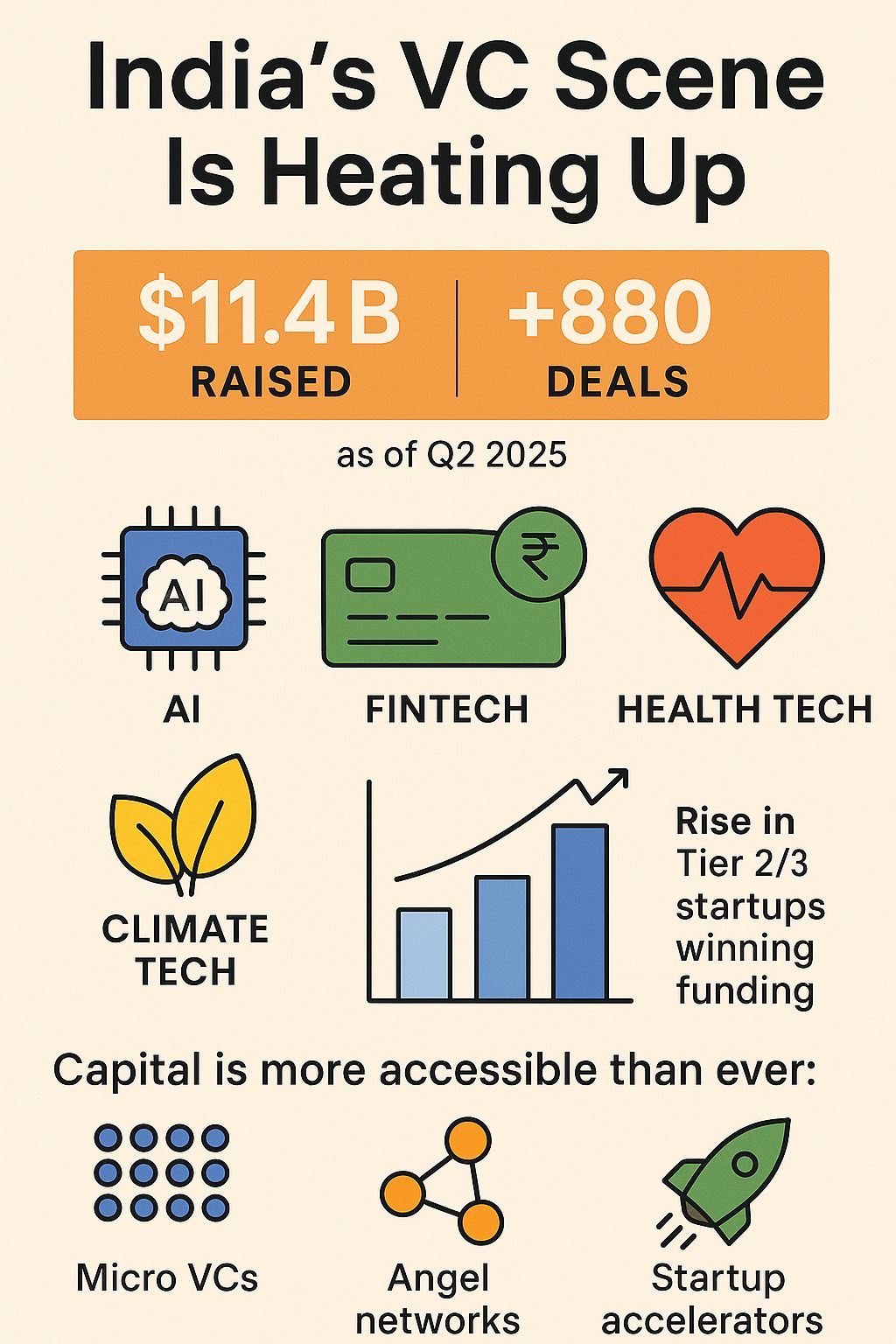

📈 Recent Affair

| India’s VC scene is heating up.

The rise of micro VCs, angel networks, and accelerators is democratising access to capital across India. |

🧠 Expert View

“The VC model only works when you're betting on outliers. Most ideas will fail — but you’re investing in the few that can reshape industries.”

— Sanjeev Bikhchandani (Info Edge & early Zomato investor)

👉His advice? “Back founders, not just ideas. Great people figure things out.”

⚡ Quick Tip of the Week

🎯 Follow startup pitch competitions like Shark Tank India, Sequoia Surge, or 100X.VC.

Even just watching will help you learn how VCs think.

🧾 Final Thought

VCs are risk-takers — they bet on dreams that the world often doubts.

But behind every unicorn is a founder who dared, and an investor who believed.

You don’t have to be a startup founder or a VC today.

Just understanding how the system works is your first power move.

Hit Reply-if you have any doubts or want to expand your knowledge about VCs and other Startup or investing related stuff.

Until next time,

The Money Edition

Bringing you clarity on how big money really flows 💼